Fuzzy logic and fuzzy set theory can be used to model financial uncertainty and challenge the use of probability theory. They can even be used to rethink Black-Scholes.

Aristotle, the father of classical logic, taught the concept of deductive reasoning through a syllogism, often attributed to him, about the teacher of his teacher Plato: “All men are mortal. Socrates is a man. Therefore, Socrates is mortal.” But approaches that use Aristotle’s logic to solve real-life problems often struggle. A far less famous Greek philosopher, Eubulides of Miletus, who invented several paradoxes that called into question the work of his contemporary Aristotle, first pointed out the limitations of classical logic. Eubulides is best known for the Sorites paradox, which asks, “At what point does a heap [sorites in Greek] of sand turn into only a handful if we take away sand grains one at a time under the assumption that a heap remains a heap after a single grain is removed?” Classical logic would conclude that the pile of sand will always be a heap because each time we remove a grain, we still have a heap — but this is obviously a false conclusion. The heap contains a finite number of sand grains; eventually, as we continue to remove grains, it must disappear.

According to classical logic, a property is either true or false. Similarly, in classical set theory, an object is either an element of a set or it is not. The real world, however, is much less black and white, as evidenced by the Sorites paradox. One obvious way to try to solve the paradox is to define a lower limit for the number of sand grains in a heap. If the number of grains exceeds the limit, the sand forms a heap; otherwise it doesn’t. But where is the limit between the two states? Can there be a strict limit? It makes more sense that there must be some smooth transition between the two states, which can be measured using uncertainty modeling, fuzzy logic and fuzzy set theory.

Fuzzy models were developed to emulate human reasoning; they use so-called fuzzy sets to describe domains of values of certain variables. Linguistic terms can be used for this purpose, as they are in human thinking. Consider adjectives like “small,” “soft” or “expensive.” “Small” has a very different meaning depending on whether we are talking about a cake, a house or a country. Moreover, we can differentiate among the “shades” of “small,” as in the case of colors. For example, “extremely small,” “very small,” “quite small” and “a bit small” all have different meanings; by using them, we can alter the meaning to achieve better modeling power. This property makes fuzzy models unique among modeling systems: By maintaining some intuitive conditions about the collection of fuzzy sets, they can be easily interpreted and understood.

Fuzzy logic and fuzzy set theory try to capture the vagueness of the real world, where classes of objects have indefinite boundaries. Fuzzy theory is the tool in uncertainty modeling that provides the best answer to many problems, including the Sorites paradox. Although Eubulides captured a theoretical problem, his paradox applies to many real-life challenges; by solving it, we can find solutions to those difficulties, too. Fuzzy clustering of data, for example, can be applied to biology, medicine, psychology, economics and many other disciplines. In the field of bioinformatics, researchers can use fuzzy-clustering pattern-recognition techniques to analyze gene sequences and the functionalities of genes within the sequences. This leads to a better understanding of the operation of living organisms. Fuzzy clustering has been an important tool in image-processing, allowing doctors to detect ventricular blood pools in cardiac magnetic resonance (CMR) imaging, which helps computer-aided medicine make more-accurate diagnoses. Fuzzy clustering also can be used to structure complex financial data.

Fuzzy theory, meanwhile, can be applied to uncertainty modeling. The fuzzy analogue of probability theory is called possibility theory and has applications in fields such as data analysis, database querying and case-based reasoning. Possibility theory provides a nonprobabilistic way to look at uncertainty and has been used by several researchers to calculate options prices. Its relevance to cognitive psychology is currently being studied. Experimental results suggest that there are situationspeople reason about uncertainty using the rules of possibility theory rather than probability theory. In one study, university students were asked to solve logical puzzles; in another experiment, medical doctors had to assess whether diagnoses were correct or incorrect on a certainty scale. In both cases, participants’ reasoning was closer to the rules of possibility theory.

Uncertainty modeling has contributed significantly to the acceleration of artificial intelligence (AI) in our lives today. Some of the most obvious examples are self-driving cars, speech recognition by devices like Amazon’s Echo and Apple’s iPhone, and Sony’s Aibo robot dog. Actually, AI is not a single science; it covers multiple disciplines. Machine learning is a form of AI that strives to make machines capable of learning. One approach to this goal is to artificially reconstruct the relevant anatomical properties of learning organisms — that is, reproduce nervous systems artificially. This is what neural networks are attempting to do, with more and more success (for example, when supercomputers defeat chess champions). On the other hand, fuzzy systems mimic cognitive functions because their main objective is to be close to human reasoning. Although this does not coincide exactly with the goal of machine learning, fuzzy architectures can be used as vehicles of machine learning due to their modeling properties. For example, they are applied in facial pattern recognition, antiskid braking systems and automated control of subway trains.

The Fuzzy Concept

Lotfi Zadeh began his pioneering work on uncertainty modeling in the mid-1960s at the University of California, Berkeley, where he introduced fuzzy sets, the central concept of fuzzy theory. Zadeh was an Azerbaijani mathematician and computer scientist who described himself in an interview as “an American, mathematically oriented, electrical engineer of Iranian descent, born in Russia.”

Zadeh’s idea was that elements or members can partially belong to sets, unlike in classical set theory, where an element is either completely contained by a set or not contained at all. In classical set theory, a set can be defined by enumerating its elements; equivalently, each element of the universe of discourse can be recorded, whether it belongs to the set or not. In fuzzy sets, not only the fact of belonging but the degree of belonging can be determined using a so-called membership function taking any real value between (and including) 0 and 1 for each element of the universe. This means that in contrast to traditional sets, where an element is either in the set (corresponding to a value of 1) or not (value 0), each element in a fuzzy set can belong to the set to a certain degree — for example, “completely” (1), “mostly” (0.75), “halfway” (0.50), “not really” (0.25) or “not at all” (0).

Take a look at the logical discrepancy of the Sorites paradox from another viewpoint. When you bought something for $1.95 and someone asked the price, did you always say it was $1.95? Perhaps you said it was $2. You probably did both, because while there are critical cases when you need to be exact, there are many everyday situations when rounding, or more generally being inexact, is a better choice. It can make communication faster, shorter and more efficient. Inexact terms can be flexible and adaptable.

This is the point where the fuzzy concept comes into play. Saying $2 instead of $1.95 covers the truth to a high degree, but not to the degree of 1 on the 0-to-1 scale.

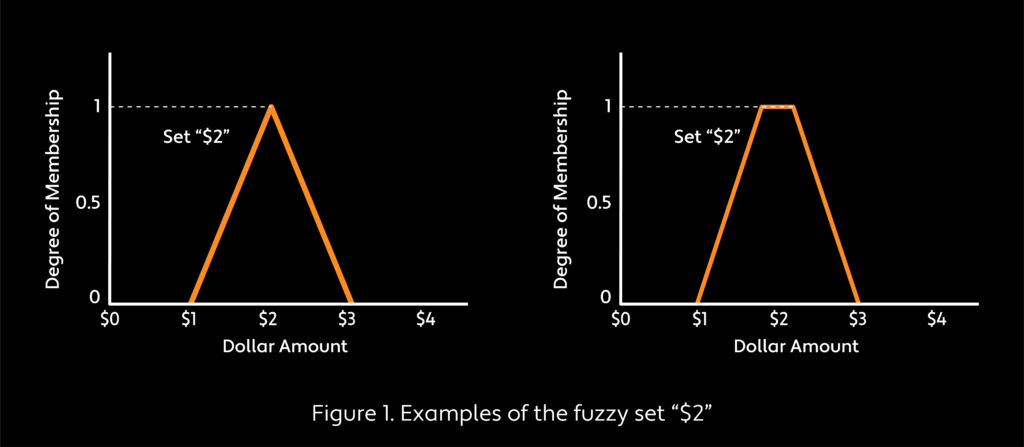

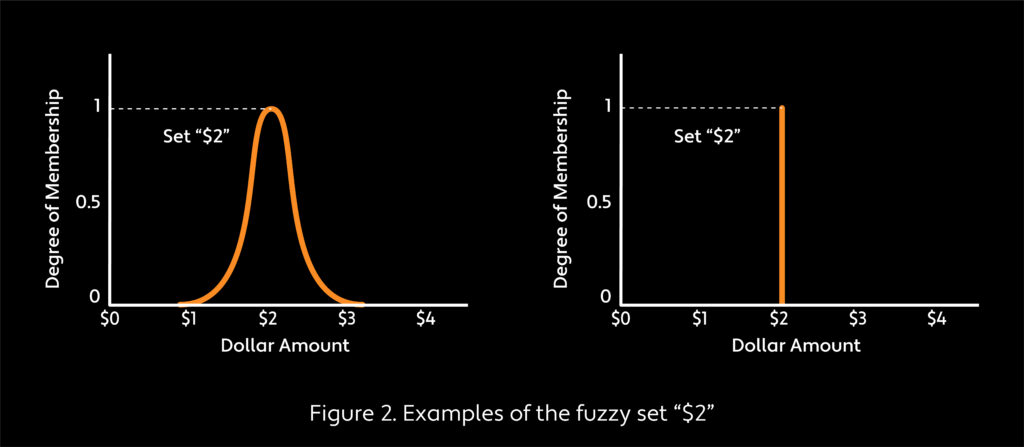

Figures 1 and 2 show some example membership functions for fuzzy set “$2”. The horizontal axes show dollar amounts and the vertical axes show corresponding degrees of belonging to fuzzy set “$2.” You can see that in three of four cases all amounts between $1 and $3 belong to “$2”: The further the value ranges from $2, the lower its degree of belonging. This can be interpreted that the further we go from $2 on the number line, the less accurate, or less true, is the statement that the amount at hand is $2. This “truth” interpretation leads to fuzzy logic (in its narrow sense; fuzzy logic in its broad sense comprises all the mathematical tools involving fuzzy mathematics). Thus, in fuzzy logic you can describe a formula that is “more or less true” or say an element has a property “only to a certain degree,” because the notion of truth as well as the relation of having a property can be represented as set membership.

It is worth providing a few more details about the interpretation of the singleton fuzzy set in the right graph of Figure 2. The singleton is the strictest fuzzy set in the sense that it allows only $2 to be in the set “$2” with a positive degree (exactly with the degree of 1), which means that it prohibits labeling any amount that’s not $2 with the term “$2.” In this way, we find ourselves back to classical set theory and classical logic.

Now that we’re armed with the basic concept of fuzzy theory, let’s discuss some ways fuzzy logic can be applied as an aid in financial modeling.

Fuzzy Clustering for Structuring Financial Data

The basic idea of clustering is to arrange data (possibly high-dimensional data with many attributes) into groups so that data in the same clusters will be of the same type. This is based on the spatial distance between data points, either in their “natural” multidimensional space or in a transformed space. Clustering can efficiently reduce dimensionality and the size of the value range along different dimensions.

Classical clustering techniques assign data points to clusters so that the clusters form a partition of the space. This means that the combination of all the clusters covers the entire space, there are no overlapping clusters, and every data point will belong to exactly one cluster and no more.

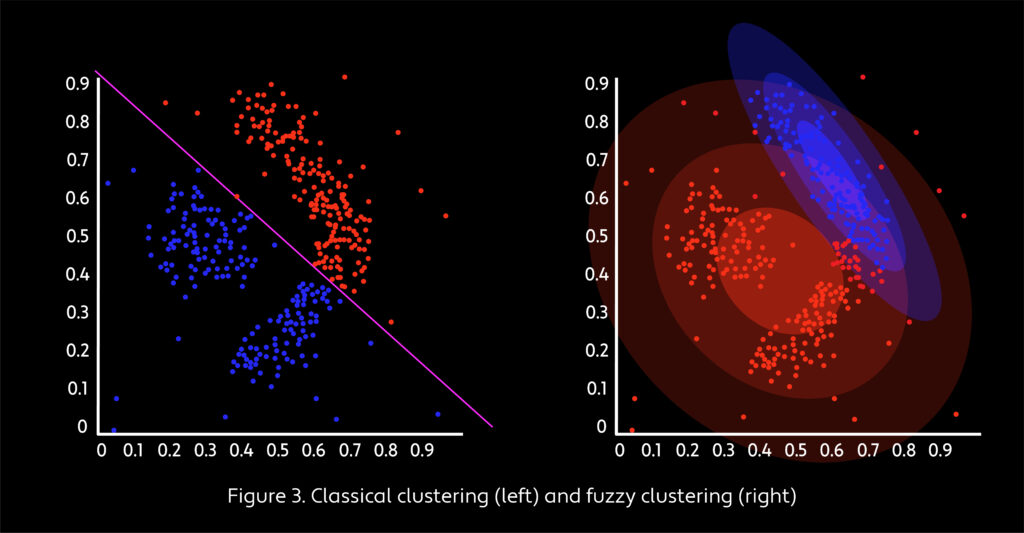

In the case of fuzzy clustering, however, the clusters have no exact borders. Every point can be an element of several (or all) clusters to a certain degree. This results in overlapping clusters and a smooth transition between clusters (see Figure 3).

The line in the image on the left in Figure 3 represents the border of the two clusters. In classical clustering, the border is strict: On one side of the line every point will be categorized as blue; on the other side every point will be red. (“Blue” and “red” can represent a lot of things depending on the problem at hand — good versus bad, satisfactory versus unsatisfactory, value stocks versus growth stocks.) The point is that there’s no difference between two blue points, and there’s no difference between two red points. A point is either blue or red.

In the fuzzy case, however, a blue point can be bluer than another blue point (e.g., a stock shows stronger value characteristics) and a red point can be redder than another red point (e.g., a stock shows stronger growth characteristics). Moreover, a point can be somewhat blue and somewhat red at the same time (in the stock example, it shows both value and growth characteristics).

Financial data can be very complex in terms of dimensionality and the variety of data values. It may be difficult both theoretically and computationally to deal with such data. Fuzzy clustering offers a helping hand here because it simultaneously decreases dimensionality and the value range. After applying fuzzy clustering, we obtain a small number (equaling the number of clusters) of low-dimensional typical data points. And all the data points can be labeled with their similarity to the typical data points — that is, their membership values.

For example, consider a financial model involving two concepts: profitability and growth potential. In this case, we can turn our attention to fundamental data, which contains a plethora of fundamental metrics. Several of them, such as profit margin, gross margin and return on assets, are related to profitability; some, such as sales growth rate, retained earnings and capital expenditure, are related to growth potential; and, of course, there are lots of metrics related to other financial aspects. It may be more convenient (and may result in a simpler and computationally more feasible model) if a fuzzy clustering is performed using two clusters, “profitable” and “not profitable,” for profitability-related metrics, and similarly “growing” and “not growing” for growth-related metrics. Using two simple concepts, we can obtain a characterization for each company and meet the needs of our financial model.

The Fuzzy Analogue of Black-Scholes

In the 1960s, to challenge the conventional role of probability in economics and to model possible rather than probable outcomes, British economist George L.S. Shackle introduced a full-fledged approach to uncertainty and decision making. Shackle called the degree of potential surprise of an event its degree of impossibility — that is, the degrees of necessity of an opposite event occurring. Zadeh reversed Shackle’s concept and suggested that the degree of possibility should be interpreted as the degree of ease. According to his famous example, “The possibility that Hans ate a certain number of eggs may be interpreted as the degree of ease with which he can eat that many eggs.” Generally, the degree of ease of an event that consists of a set of elementary hypotheses is the degree of ease of its easiest realization. In other words, when aggregating different events to determine an overall possibility, one must take the maximum of the possibilities of individual events instead of the sum of them — in fuzzy logic, this means a so-called maxitivity property comes into play rather than conventional probability’s theoretical additivity. (For an example to the additivity property: the probability of obtaining at least five when rolling a six-sided die is one third because the probability of five and six is each one sixth.)

This idea can be illustrated in a financial context. Let’s consider an accounting company facing different threats with different levels of severity. The firm has been sued by several customers, drawing media attention that could harm its reputation. Hence, there’s a certain degree of possibility (say, 0.3 on a 0-to-1 scale) that the company will default, though this possibility is not very high. However, the firm’s well-performing CEO is about to retire. A disastrous succession could trigger a default, albeit with an even smaller possibility (say, 0.1). Compared with the lawsuits, succession does not really suggest much of a threat at all. Therefore, the possibility of default remains 0.3 and the consequences of the lawsuits remain the easiest realization of that default. Then, suddenly, the authorities suspend the accounting license of the firm because of a criminal investigation. This is a huge problem, as the company cannot provide its services until it gets its license back; this means default has a very high degree of possibility (say, 0.9). Because this leads to the easiest realization of default, the aggregated possibility will be 0.9.

In 1978, Zadeh proposed an interpretation of membership functions of fuzzy sets (the functions defining degrees of belonging for each element in the universe of discourse) as the possibility distributions used by natural language statements.

Based on this possibility theory, the fuzzy analogues of random variables, probability distributions, expected value, variance and stochastic integrals, among others, can all be defined and similar theorems can be proved, as in the case of probability theory, on the basis of analogously defined concepts. This foreshadows the likelihood that possibility theory might be able to provide useful models for financial applications.

This proves to be true in the case of options pricing. Because the price of a derivative is based partly on the future price of the underlying asset, there is an element of uncertainty involved. For this reason, pricing models typically include some amount of randomness. One of the most important financial models, the Black-Scholes options pricing model, is based on the assumption that stock prices can be modeled using a stochastic process over a probability space. However, there are several other approaches to options modeling, including one proposed by Chinese mathematician Baoding Liu. Instead of using traditional probability tools, Liu defined a possibility vehicle — a fuzzy process— as a model for stock price movements. By applying fuzzy processes, Liu established a possibility theoretical model for options pricing — the fuzzy analogue of the Black-Scholes model.

William Ely, an Israel-based consultant, did an extensive comparison of the Black-Scholes and Liu models for his master’s thesis, performing simulations using different strike prices and different time frames. Ely then compared the prices predicted by the models to the corresponding actual options prices. For this purpose, he used two error definitions: mean absolute error (MAE) and root mean squared error (RMSE). The former measures the absolute difference between the predicted and the actual prices; the latter, by squaring the differences between the values, “tends to give more weight to errors of high magnitude,” Ely explains.

The Liu model outperformed the Black-Scholes model over all strike prices and both error measures when the interval of the comparison was 120 days or less. Going out to 150 days, the Liu model also performed better for the majority of the strike prices. When the simulation included 180 days, the Black-Scholes model started to outperform the fuzzy analogue; in the case of the RMSE measure, Black-Scholes gave better predictions for all strike prices. This trend continued as the time frames got longer: For 210 days or more, the Black-Scholes model clearly outperformed the Liu model for all strike prices and both error measures.

Perhaps the most striking result of Ely’s analysis is that the Liu model consistently outperforms the Black-Scholes model over short time periods. As was mentioned earlier, the shift in predictive power started after 120 days, and the Black-Scholes model only really outperforms the fuzzy analogue at around 200 days. Although Black-Scholes remains a viable benchmark model, the fuzzy approach to options pricing proves its worth, especially considering that options with closer expiration dates tend to be traded more heavily.

After acquiring some insight into fuzzy theory and its applications in financial modeling, we can return to the Sorites paradox and resolve it easily: Consider the set of sand heaps as a fuzzy set where, depending on their size, individual heaps have different membership values. In this case, every time we reduce the number of sand grains, we produce a heap with a slightly lower membership value — that is, we decrease the degree of it’s being a heap bit by bit. Tangibly, this means the heap shrinks. Following this model, it is undeniable that even a couple of sand grains can be considered a heap, but with a negligibly low degree.

Krisztian Balazs is a Vice President, Research, at WorldQuant and has a PhD in computer science from Budapest University of Technology and Economics.